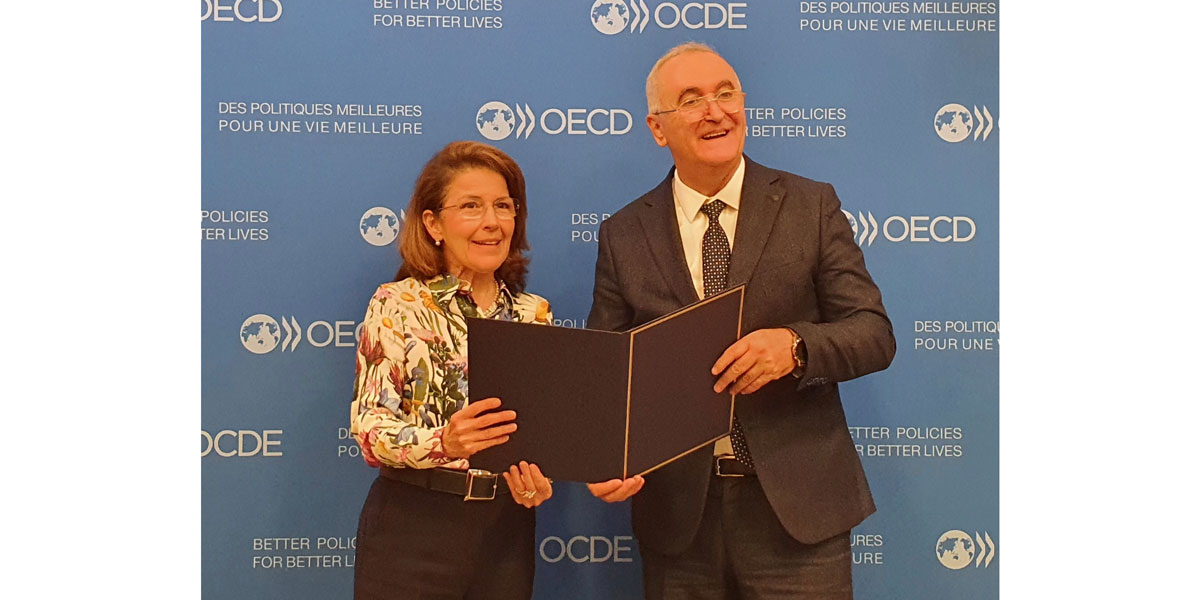

The OECD, in an announcement, confirmed that Algeria signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (BEPS Convention) on 27 June, 2024.

Algeria has become the 103rd jurisdiction to join the BEPS Convention, which now covers around 1950 bilateral tax treaties. This represents an important milestone in the implementation of treaty-related BEPS measures and the strengthening of the global tax treaty network.

The country plans to apply the MLI to 35 of its tax treaties, according to Algeria’s provisional list of reservations and notifications. For the MLI to take effect for any specific treaty, both parties must designate the treaty as a covered agreement and complete the necessary ratification procedures.

Presently, over 1400 treaties concluded among the 85 jurisdictions which have ratified, accepted or approved the BEPS Convention have already been modified by the BEPS Convention. The BEPS Convention is the world’s leading instrument for updating bilateral tax treaties and reducing opportunities for tax avoidance by multinational enterprises.